FDIC-Insured - Backed by the full faith and credit of the U.S. Government

ISO 20022 is a global standard designed to enhance security, efficiency, and transparency in wire transfers. The Federal Reserve transitioned to this system in 2025 to improve payment tracking, and reduce processing errors. All wires sent through the Federal Reserve are processed in compliance with the ISO 20022 standards.

Have questions? We’re here to help. Keep reading to learn more.

Wire Terminology

Below is a quick comparison of the previous wire terminology to the current ISO 20022 format.

| Previous Wire Field | ISO 20022 Field |

| Recipient | Creditor |

| Originator | Debtor |

| Origination Bank/Sending Bank | Debtor and Instructing Agent |

| Recipient Bank | Creditor Agent |

| Beneficiary Institution | Instructed Agent |

| International Intermediary Bank | Intermediary Agent |

| Routing Number | Routing/ABA Number |

| Address Line 1 | Building number and Street name |

| Address Line 2/3 | Department, Sub Department, PO Box, Building Name, Room, Floor, Town Location, District Name |

| City | Town Name |

| State | Country subdivision |

| Zip Code | Postal Code |

| Country | Country (Country Code) |

| Notes | Remittance Information |

Client Guide: ISO 20022 Wire Transfer Standard

Review the quick-reference guide which contains everything you need to know about the ISO 20022 standard.

ISO 20022 Frequently Asked Questions

What is ISO 20022 and why was it implemented?

ISO 20022 is a global standard for electronic payments that enhances security, transparency, and efficiency in wire transfers. The Federal Reserve converted to this system on July 14, 2025 to align with global standards, improve payment tracking, and reduce processing errors.

How does this affect me?

All wires sent through the Federal Reserve must be in compliance with the ISO 20022 standard. The Bank formats wires this way, but wire transfers orders made to the bank must include specific information including detailed physical address information for Creditors and Creditor Agents (Banks).

How will this impact my wire transfers?

All wire transfers sent through the Federal Reserve will need to be in compliance with the ISO 20022 standards. For Online Banking wire clients, the fields where you enter wire transfer detail use ISO field names and some basic field descriptions. For wire transfers ordered with a banker or by phone, our staff can help translate wire instructions into the ISO format. The ISO 20022 Client Wire Transfer Reference Guide compares the previous and current ISO terms and field names in detail. It also contains a basic wire instruction template with the minimum information you need to collect from your payee in order to process a wire transfer in the ISO format.

Where can I get more information?

Our Wire team is here to help!

- Phone | 419-841-7773

- Email | wires@signaturebankna.com

The Federal Reserve also has additional resources available.

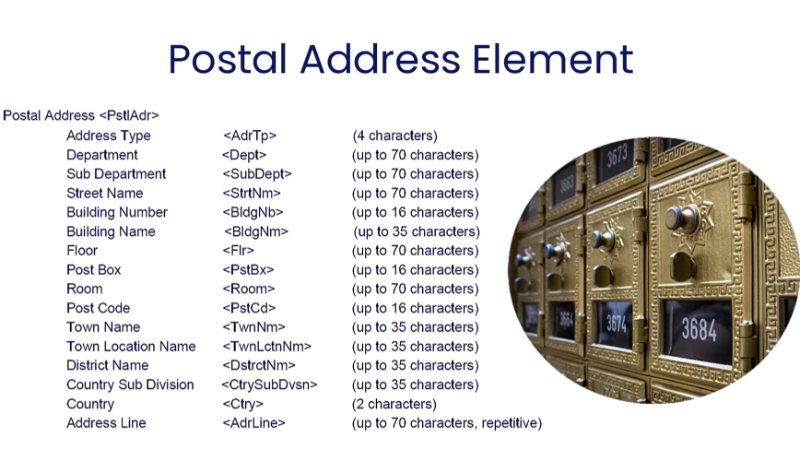

Do I need to be aware of any character limits?

Can I receive notices for incoming or outgoing wire transfers?

Yes, wire notifications are available through postal mail or eStatements in Online Banking. You can also set up alerts within Online Banking to receive email notifications when wire transfers are processed.