News & Education

At Signature Bank, we understand the importance of safeguarding your sensitive information. To assist you in strengthening your cybersecurity, we will be sharing common cyber threats and ways to protect yourself from scams. Please stay connected with us throughout the year to stay informed and secure.

In this segment, we'll discover techniques for spotting red flags and safeguarding against email scams.

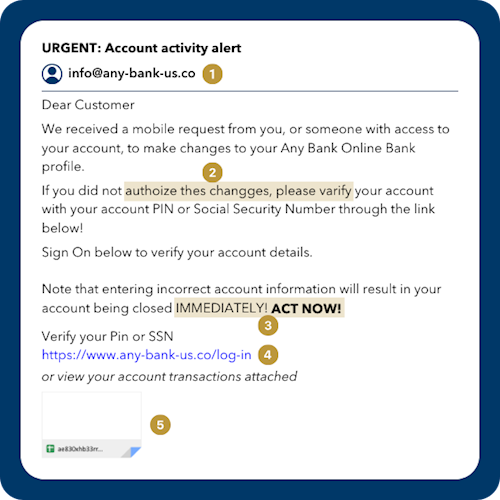

🚩 Can you detect the red flags in the sample email below?

1. Unusual Email Address

Take your time. Does that look like an email address your bank typically uses? Exercise caution with unexpected emails from unfamiliar addresses, especially those not typical of your bank's communication.

2. Misspelled Words

Do a quick check! If you see misspelled words or odd grammar, they are all clear signs of an impersonator. Legitimate banks use spell check.

3. Scare Tactics

Don’t panic. If an email uses scare tactics, such as urgent warnings of account closure or security breaches, you can safely assume it’s a scam.

4. Suspicious URLs

Wait a moment. Banks will never ask you to log in via email. Phishing emails use deceptive URLs to take you to malicious websites. Never click links that you weren’t expecting.

5. Unexpected Attachments

Stay vigilant. Legitimate banks will never send an email attachment, especially when you didn’t ask for it. Attachments can contain malware that can compromise your computer or personal information. Never click on attachments from emails supposedly from your bank.

If you still have concerns about the legitimacy of the email and need to take action, verify its authenticity by calling the sender using a valid and publicly listed phone number.

Source: American Bankers Association (2023). Banks Never Ask That.

The above referenced source is provided as a courtesy. Signature Bank does not endorse or control the content of this source or website.